Our recipe of success lies in personalized attention and we see every client’s business as if it were ours. This allows us to focus the situations from a client ways, taking real ownership and responsibility. We work closely with our clients, helping them to moderate risks and hold on opportunities.

WWAS provides the highest standards of accounting and Bookkeeping services to our clients because of our focus on the three work principles of professionalism, quantity & quality.

Our Vision

With enormous hard work, dedication and passion, we strive to become one of UAE’s most prestigious accounting firms.

Our Mission

Our mission is to build client relationship, mount reputation amongst our clients and improve every project that we are engaged on by providing high level of service, clear leadership and creating value.

About Us

Meet the accounting and bookkeeping services provider in uae.

Our client services team has more than 20 year’s experience in providing accounting and bookkeeping services in dubai, vat and tax management accounts preparation. We provide a personalized portfolio based on a strategy reflecting your situation. We help you to solve your business & tax problems.

Our Audit Partners

Accounting Services

- Bookkeeping And Accounting Systems Implementation

- Maintenance Of Monthly Books

- Monthly Reports Of Financial Statements

- Bank And Ledgers Reconciliation

- Mis Reporting (Monthly & Yearly)

- Internal Audit And Review

- Assisting Statutory Audit & External Audit

Other Services

- Hr Solutions

- Pro Services

- Gro Services

VAT & TAX Consultancy Services

- Vat Registration

- Assistance In –

- Establishing Vat Charging Systems

- Filing/preparing Quarterly Vat Returns

- Maintenance Of Vat Records

- Vat Profile Updates

- Guidance On Tax Regulations

- Vat Implementation, Vat Support, Vat Consulting, VAT Assessment

- VAT Assessment, Quarterly Tax Filing And Tax Return

- Corporate Tax Registration & Filing

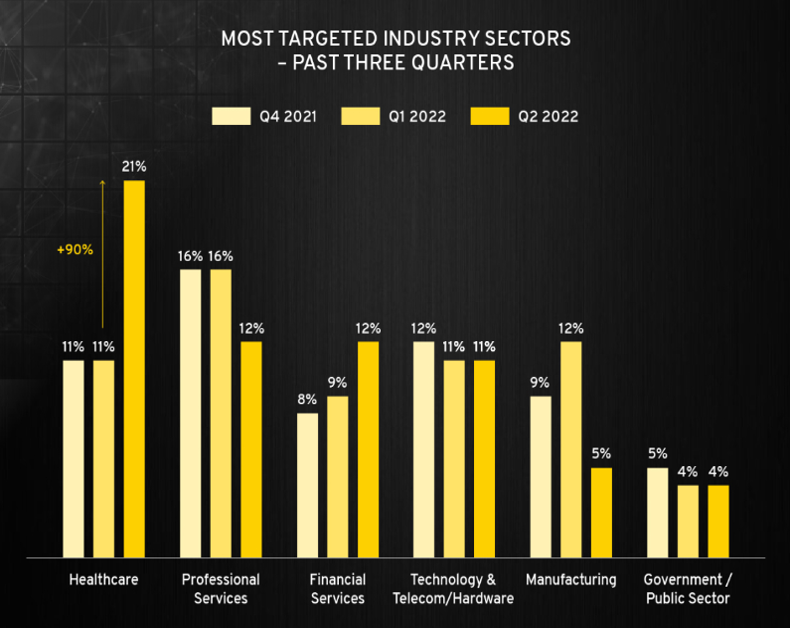

Targeted Sectors

- Hospitality Industries

. Hotels

. Restaurants

. Malls & Theme Parks - Retail Industries

- Boutique & Fashion House

- Small Scale Industries

- Life Style Industries

- Real-Estate

- E-Commerce Services

- Social Media Services

- Marketing

Hotel Accounting

Hotel accounting refers to the process of managing financial transactions and records in a hotel or hospitality business. Hotel accounting is a specialized area of accounting that requires knowledge of the unique revenue and expense cycles in the hospitality industry.

The primary objective of hotel accounting is to ensure accurate financial reporting and to provide timely and relevant financial information to management for decision-making purposes. Hotel accounting typically includes managing accounts payable and receivable, payroll, general ledger, financial statements, tax compliance, and budgeting.

Revenue management is a critical component of hotel accounting, as hotels generate revenue through a variety of sources, including room sales, food and beverage sales, event sales, and other services. Hotel accountants must carefully track revenue and expenses in each area to ensure that the business is profitable.

Hotel accounting also involves managing inventory and cost of goods sold (COGS) for food and beverage operations. Food and beverage costs can be a significant expense for hotels, and accountants must carefully manage inventory levels and track the cost of goods sold to ensure profitability.

In addition to financial reporting and analysis, hotel accounting may also involve compliance with regulatory and industry-specific requirements, such as tax regulations and financial reporting standards. Hotel accountants must stay up to date on these requirements to ensure that the business remains compliant.

Overall, effective hotel accounting is essential for the financial health and success of a hotel or hospitality business. By providing accurate financial information and strategic insights, hotel accountants can help businesses make informed decisions and achieve their financial goals.

Management Advisory

Management advisory refers to the process of providing expert advice and guidance to businesses and organizations to improve their overall performance and achieve their strategic objectives. Management advisors, also known as management consultants, work with organizations to identify their key challenges, develop strategies to overcome them, and implement solutions to achieve success.

Management advisory services typically cover a wide range of areas, including organizational design, business process improvement, human resources management, financial management, information technology, marketing, and sales. Management advisors may also provide specialized expertise in areas such as mergers and acquisitions, corporate strategy, and risk management.

The goal of management advisory is to help organizations identify and address critical issues that affect their performance, profitability, and growth. Management advisors use a range of analytical tools, methodologies, and frameworks to analyze data, assess risks, and develop recommendations for action. Overall, management advisory can provide valuable insights and guidance for organizations looking to improve their operations, increase their competitiveness, and achieve long-term success.

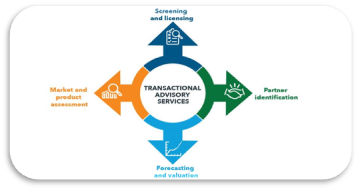

Transaction Advisory

Transaction advisory services typically cover a range of areas, including financial due diligence, tax planning, valuation, accounting, legal, and regulatory compliance. Transaction advisors also provide support in negotiating and structuring the deal, and may assist with post-transaction integration planning.

Transaction advisory refers to the process of providing advice and support to businesses and organizations during mergers, acquisitions, divestitures, or other types of transactions. Transaction advisors work with clients to assess the risks and opportunities of a transaction, identify potential issues and challenges, and develop strategies to mitigate those risks.

The goal of transaction advisory is to help clients make informed decisions about transactions and maximize the value of their investments. Transaction advisors use a range of analytical tools, methodologies, and frameworks to assess the financial and strategic implications of a transaction and provide recommendations to their clients. Overall, transaction advisory can provide valuable support and guidance for businesses and organizations looking to navigate complex transactions, minimize risks, and maximize returns on their investments.

Financial Solutions

Financing solutions refer to the various methods and instruments that businesses and individuals can use to raise funds for their operations, investments, or other financial needs. Some common financing solutions include:

- Equity financing: This involves raising funds by selling ownership stakes in a business to investors. Equity financing can be done through private placements, initial public offerings (IPOs), or crowdfunding.

- Debt financing: This involves raising funds by borrowing money from lenders. Debt financing can be done through bank loans, bonds, or other debt instruments.

- Lease financing: This involves obtaining the use of an asset, such as equipment or real estate, by making regular payments over a set period of time.

- Factoring: This involves selling accounts receivable to a factoring company at a discount to raise cash quickly.

- Merchant cash advances: This involves borrowing money against future credit card sales, with repayment based on a percentage of daily sales.

- Crowdfunding: This involves raising funds through small contributions from a large number of individuals, often through online platforms.

- Government grants or loans: These are funds provided by government agencies to support specific types of businesses or projects.

- Venture capital: This involves raising funds from venture capital firms, which provide funding in exchange for an ownership stake in a startup or high-growth business. Each financing solution has its own advantages and disadvantages, and the best option will depend on the specific needs and circumstances of the borrower. By carefully considering their financing options and working with experienced advisors, businesses and individuals can find the right financing solution to meet their needs and achieve their financial goals.

Payroll Management

Payroll management refers to the process of managing and processing employee compensation, including salaries, wages, bonuses, and deductions. Payroll management is an essential function for any business with employees, as it ensures that employees are paid accurately and on time, while also complying with applicable tax and labor laws.

The key steps involved in payroll management include:

-Recording employee time and attendance data: This includes tracking employee hours worked, overtime, and time off requests.

-Calculating employee compensation: This includes calculating gross pay, deductions, taxes, and net pay.

-Processing payroll: This involves preparing payroll checks or direct deposits, distributing pay stubs, and recording payroll transactions in accounting systems.

-Managing payroll taxes: This includes calculating, withholding, and remitting federal, state, and local taxes, as well as managing employee contributions to retirement plans, health insurance, and other benefits.

-Ensuring compliance with labor laws: This includes complying with minimum wage laws, overtime rules, and other regulations governing employee compensation.

-Maintaining accurate payroll records: This includes keeping records of employee pay rates, hours worked, tax withholdings, and other payroll-related data.

To effectively manage payroll, businesses may use payroll software, which automates many of the processes involved in payroll management, including time tracking, compensation calculation, and tax compliance. Payroll software can also generate reports, track employee benefits, and integrate with accounting systems.

By effectively managing payroll, businesses can ensure that employees are paid accurately and on time, while also minimizing the risk of errors, penalties, and compliance issues.

VAT & Corporate Tax

VAT submission refers to the process of reporting and submitting Value Added Tax (VAT) returns to the relevant tax authority. VAT is a consumption tax that is applied to the sale of goods and services, and is collected by businesses on behalf of the government. In most countries, businesses are required to register for VAT if their annual sales exceed a certain threshold. Once registered, businesses must charge VAT on their sales, and are entitled to recover VAT paid on purchases related to their business activities.

VAT returns are typically submitted to the tax authority on a monthly or quarterly basis, depending on the rules in the relevant jurisdiction. The VAT return summarizes the business’s sales, purchases, and VAT owed or reclaimable for the reporting period. The VAT return must be submitted by a specified deadline, and any VAT owed must be paid by the same deadline. The VAT submission process may be done manually or electronically, depending on the requirements of the tax authority. Many countries now require VAT returns to be submitted electronically, and may provide online portals or software for businesses to use.

To ensure accurate VAT submission, businesses must maintain detailed records of their sales, purchases, and VAT transactions. This may include keeping track of invoices, receipts, and other documentation related to VAT. Some businesses may choose to work with an accountant or tax advisor to help with VAT compliance and submission.

Overall, effective VAT submission is essential for businesses to remain compliant with tax laws and avoid penalties or fines. By maintaining accurate records and timely submission of VAT returns, businesses can ensure they are fulfilling their tax obligations and maintaining good standing with tax authorities.

The corporate tax in UAE will be payable on the profits of UAE businesses as reported in their financial statements prepared in accordance with internationally accepted accounting standards. There will be minimal exceptions and adjustments. This clearly means that financial statements must now be without exception audited on time.

The extraction of natural resources, likely to remain subject to emirate-level corporate taxation (for example, a different corporate tax in Dubai from one in Abu Dhabi or any other emirate) is to be the only business activity with tax exception, the announcement says. Exemptions, subject to some conditions, will also apply to entities operating in Free Zones.

With this introduction of conditions, concerns about the global minimum 15% income tax are also likely to be addressed. No withholding taxes will be imposed, and with the Foreign Tax credit in the UAE, there will be no payment of additional taxes to the extent of credit allowed.

There is to be no corporate tax in UAE on capital gains and dividends which will continue to boost the holding company structure. The new tax regime allows group tax registrations or taxability at a group level. Hence, inter-company losses shall be allowed in computing taxable profits.

Transfer pricing and documentation requirements will apply to UAE businesses in reference to the OECD Transfer Pricing Guidelines.

Internal Audit Services

Audit services refer to the professional services provided by independent auditors to examine and provide an opinion on the financial statements of an organization. The objective of an audit is to provide assurance that the financial statements are presented fairly and accurately in accordance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

The key steps involved in audit services include:

- Planning: This involves assessing the risks of material misstatement in the financial statements and developing an audit plan to dress those risks.

- Fieldwork: This involves conducting audit procedures, such as reviewing accounting records, testing internal controls, and verifying account balances and transactions.

- Reporting: This involves communicating the results of the audit to management and issuing an audit report that provides an opinion on the fairness of the financial statements.

Auditors may also provide other services related to financial reporting, such as reviews of interim financial statements or audits of internal controls over financial reporting.

Audit services are typically required by law for publicly traded companies, but may also be voluntarily obtained by private companies or nonprofit organizations. Audits can provide valuable information to stakeholders, including investors, creditors, and regulators, and can help organizations identify areas for improvement in their financial reporting and internal controls.

To ensure the quality of audit services, auditors must adhere to professional standards and ethical principles, and undergo regular training and continuing education. Auditors may also be subject to external oversight and regulatory scrutiny to ensure compliance with auditing standards and best practices.

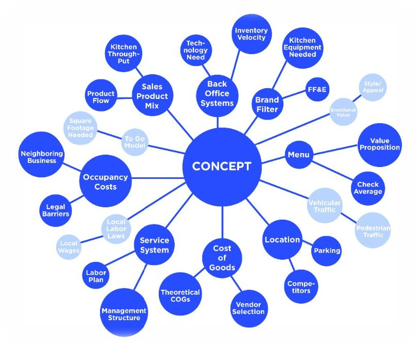

F& B Concepts & Menu Engineering

F&B concepts refer to the ideas and strategies that define the food and beverage offerings of a restaurant or food service establishment. A successful F&B concept should reflect the unique brand identity of the establishment, meet the needs and preferences of the target audience, and provide a high-quality dining experience.

Some common F&B concepts include:

- Casual dining: This concept typically offers a relaxed, informal atmosphere and a menu of moderately priced, familiar dishes.

- Fine dining: This concept offers an upscale, formal atmosphere and a menu of high-quality, often gourmet dishes.

- Ethnic cuisine: This concept focuses on the cuisine of a particular region or country, offering a menu of authentic dishes and flavors.

- Farm-to-table: This concept emphasizes the use of locally sourced, seasonal ingredients in the menu, often with a focus on sustainability and environmental responsibility.

- Fast-casual: This concept offers a quick, convenient dining experience with a menu of freshly prepared, customizable dishes.

- Food trucks: This concept offers mobile food service, typically specializing in a particular cuisine or menu item.

In addition to the menu and atmosphere, F&B concepts may also incorporate elements such as branding, marketing, and service style to create a unique and memorable dining experience. Successful F&B concepts should also be adaptable to changing trends and preferences, while maintaining their core identity and values.

Overall, a well-defined F&B concept can be a key differentiator in a crowded and competitive restaurant market, and can help to attract and retain customers and build a strong brand identity.

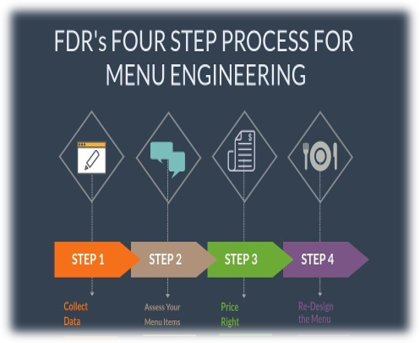

Menu engineering is a strategic approach used by restaurants and other food service establishments to optimize their menu in terms of profitability and popularity. The goal of menu engineering is to use data analysis to identify the most profitable menu items, as well as those with the highest customer demand, and to make strategic adjustments to the menu to maximize sales and revenue.

The key steps involved in menu engineering include:

- Menu analysis: This involves reviewing sales data and customer feedback to identify the most popular and profitable menu items.

- Menu optimization: This involves making adjustments to the menu to highlight the most profitable and popular items, such as using visual cues or menu placement to draw attention to these items.

- Menu pricing: This involves setting prices for menu items based on their profitability and popularity, as well as factors such as ingredient costs and competition.

- Menu testing: This involves trialing new menu items or changes to the menu to assess their impact on sales and profitability.

Menu engineering may also involve segmenting the menu into categories, such as appetizers, entrees, and desserts, and analyzing the sales and profitability of each category to inform menu optimization and pricing decisions.

By using data analysis to inform menu decisions, menu engineering can help food service establishments to increase revenue and profitability, while also providing a more satisfying dining experience for customers. Successful menu engineering requires a strong understanding of menu design and pricing strategies, as well as the ability to analyze and interpret sales data and customer feedback.